Protecting Client Data Is Harder Than Ever in Finance

Stop costly breaches

Legacy tools miss shadow data, leaving customer PII exposed and inviting fraud and fines.

Simplify compliance

Automate PCI DSS, GLBA, and CCPA evidence with instant data maps and audit‑ ready reports.

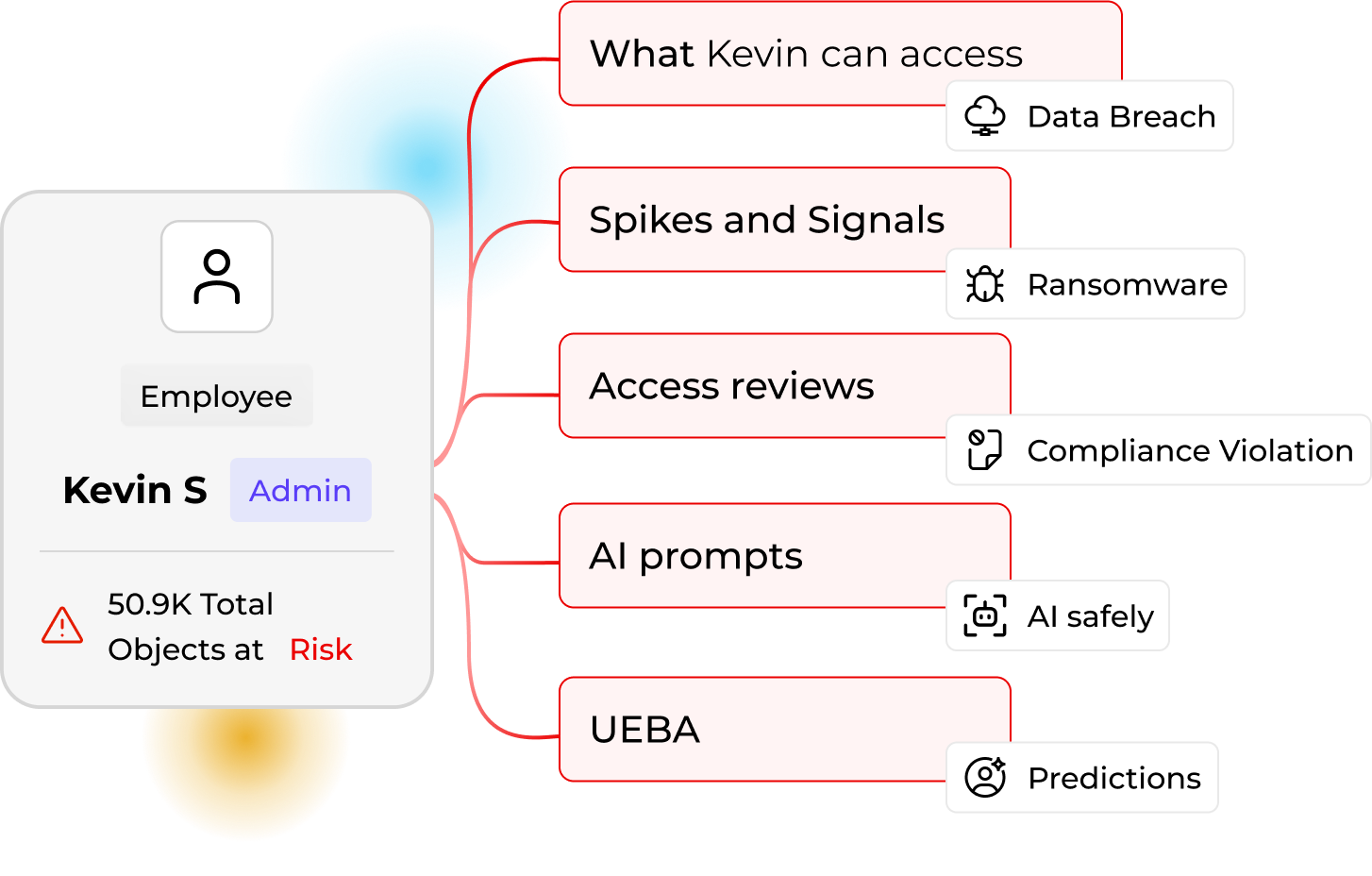

Control data access

See who accesses whose data, trim excess permissions, and stop exfiltration everywhere.

Reduce risk, cut audit time, and free budgets for innovation

96%

Discovery accuracy

Find PII accurately in SharePoint, OneDrive and databases within hours, not weeks.

80%

Audit effort saved

Generate PCI evidence, cutting audit time and consulting fees.

40%

Reduced tooling costs

Replace point tools with one unified platform that scales enterprise‑ wide.

“If a data breach occurred, it could have been a $100,000 issue. Now, using Lightbeam, the cost becomes zero.”

Chris O’Leary

COO, Infinite Investment Systems

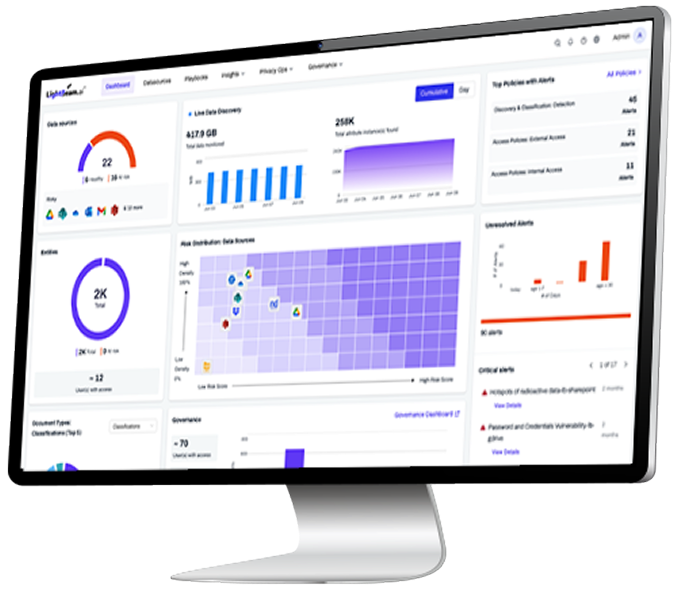

See more, govern faster, comply easier

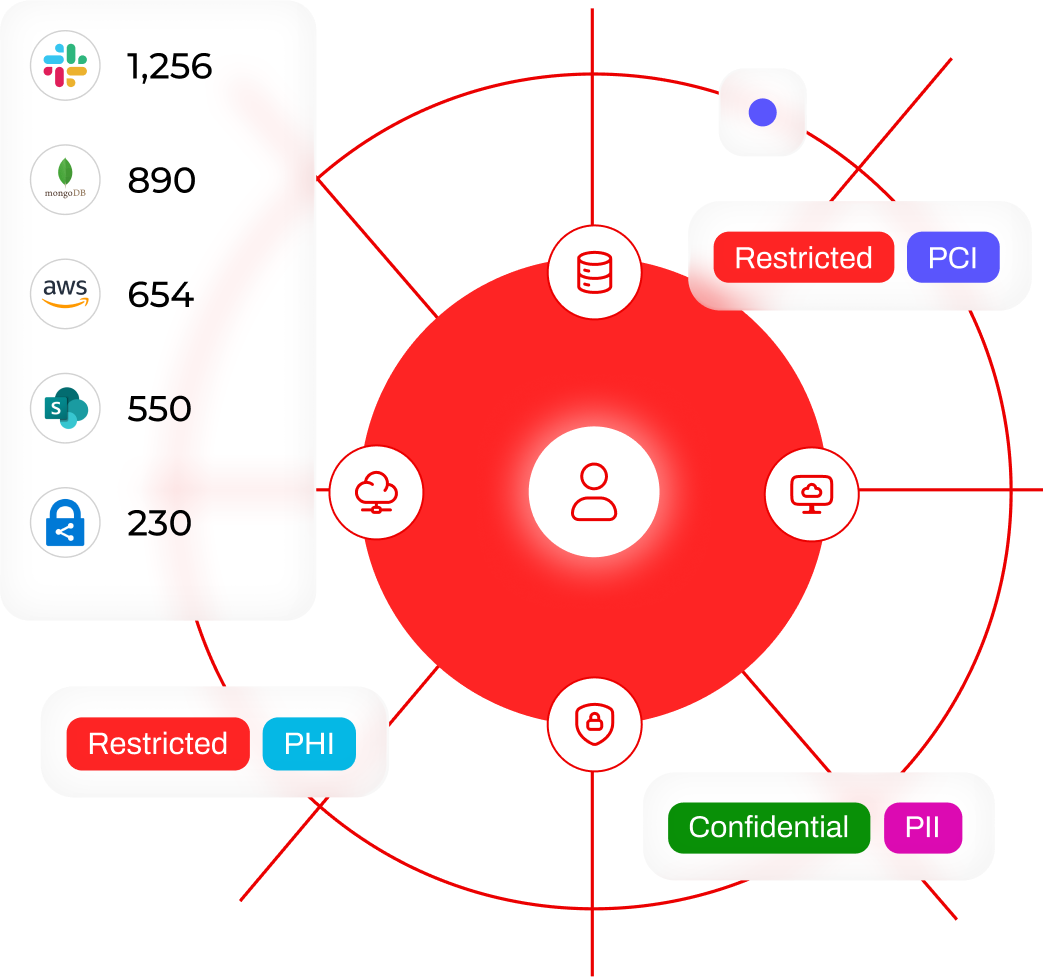

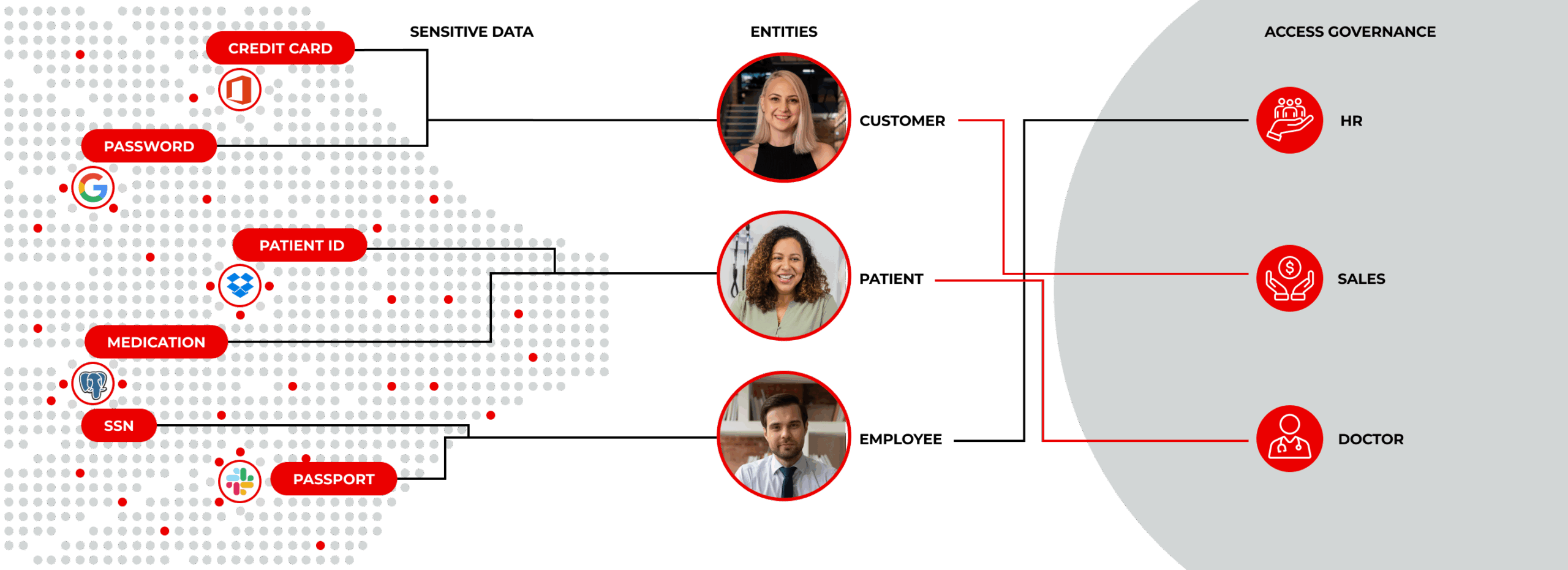

Identity-Centric Discovery

Map every customer record to the people it represents, eliminating blind spots, shadow data, and false positives that plague regex‑ based tools.

Explore DSPMAutomated Governance

Enforce file access, retention, and redaction policies in real time with AI, including automatic access revocation when thresholds are met, with complete audit trails.

Explore Access GovernancePrivacy Workflows

Slash DSR handling costs by 80 % with self‑ service portals, automated RoPA, consent tracking, and instant evidence for regulators such as OCC and CFPB.

Explore Privacy at Scale

Discover, Govern, and Protect Financial Data at Scale

Navigate Key Data Regulations with Confidence

GDPR

Lightbeam automates RoPA, PIA, and DSR workflows, giving European regulators the evidence they demand while your team focuses on innovation, not inboxes.

Learn More

CCPA

Automate consumer disclosures and opt-outs, validate deletion and monitor data sharing to stay ahead of California enforcement.

Learn More

PCI-DSS

Map payment card data across databases and shared drives, apply least privilege policies, and generate audit ready PCI reports in clicks instead of days.

Learn MoreLeaders who trust Lightbeam

Frequently Asked Questions

How does the platform help meet PCI DSS 4.0 without adding staff?

Lightbeam automatically discovers and classifies cardholder data, maps it to access rights, and exports the evidence needed for Requirements 2, 3, and 7. This cuts manual sampling and prepares auditors with real‑ time dashboards and signed reports.

Explore DSPMDoes Risk Scoring revoke access or rely on user behavior analytics?

No. Risk Scoring evaluates the content of files and the business impact you choose, not user activity. You can adjust weighting, add attributes, and trigger policies, but the score itself never removes access automatically. Playbooks can be created to automatically revoke access if desired.

Dive into Risk ScoringWhere is data processed for Canadian or EU residency requirements?

You choose SaaS, private cloud, or on‑ prem deployment. Financial clients such as Infinite Investments run Lightbeam completely within Canadian data centers to keep every byte local while still getting full feature parity.

Our Platform